Savings Bucket Feature

Chase Banking App, Add a Feature

With the growing use of financial apps, there has been a growing interest in personal finance management and digital banking solutions that offer customers greater control over their finances. More flexibility, customization options, and insights to help them achieve their savings goals effectively.

A survey by NerdWallet in 2021 found that 42% of Americans were saving for a specific goal other than retirement or emergencies, such as vacations or large purchases.

Introducing a savings bucket would help customers reach their financial goals faster by letting them set customized targets with realistic timelines.

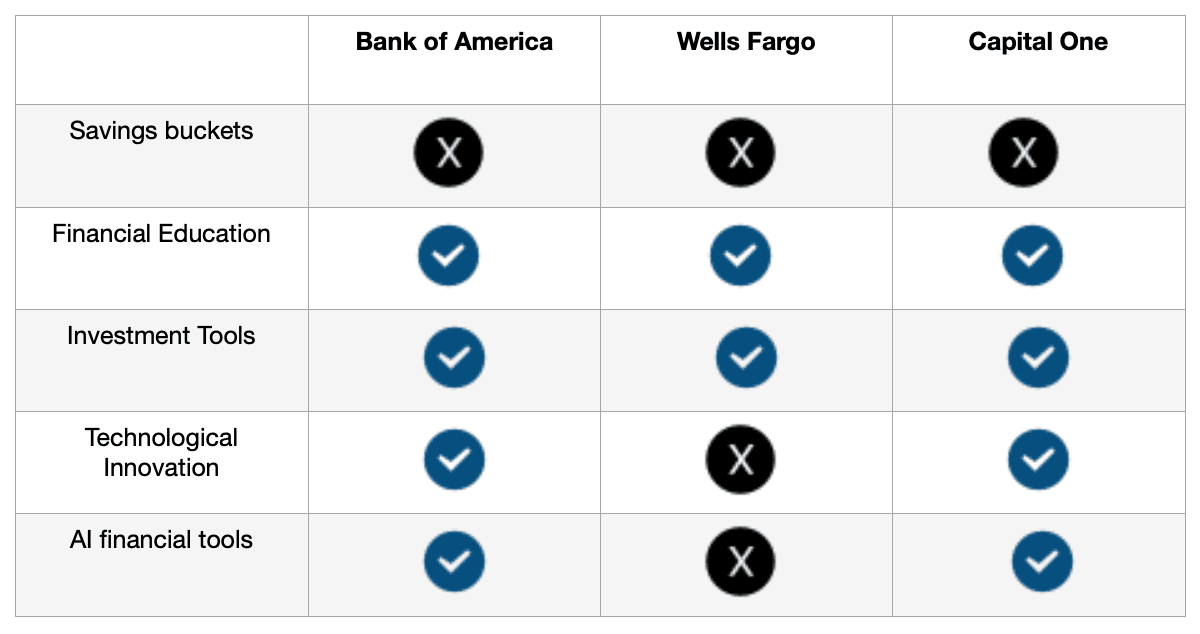

Competitive Analysis

User Research

Savings habits and preferences among current Chase savings customers.

5 user interviews conducted through Google meet

Demographics: People ages 18-70 who are current Chase banking app users and save regularly.

How do people currently save for goals?

Through Autosave but would like greater control over their savings goals

Using other various financial apps

How do they use their Chase savings app?

Only to check their savings balance

Not aware of when they will reach their financial goals

Checks balance almost daily if not weekly

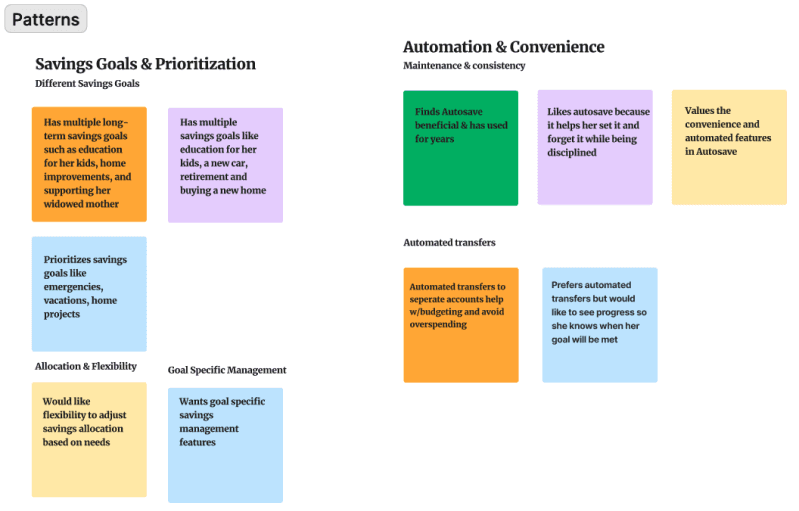

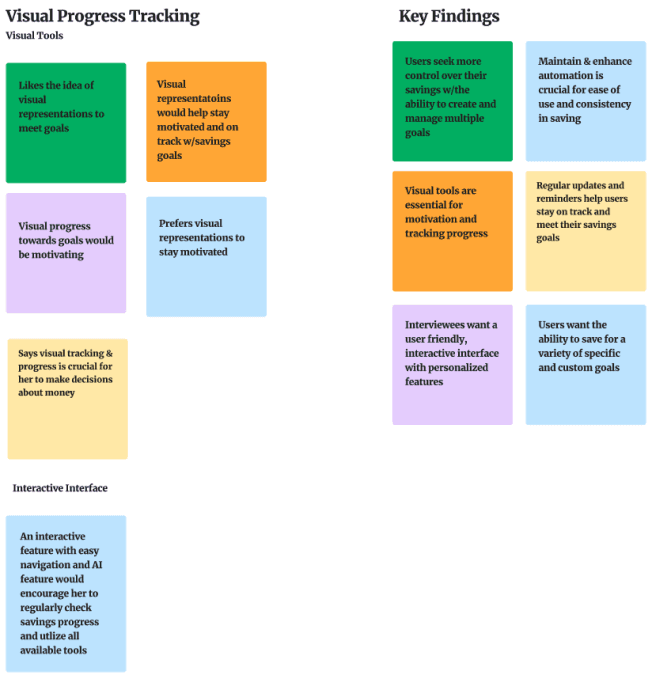

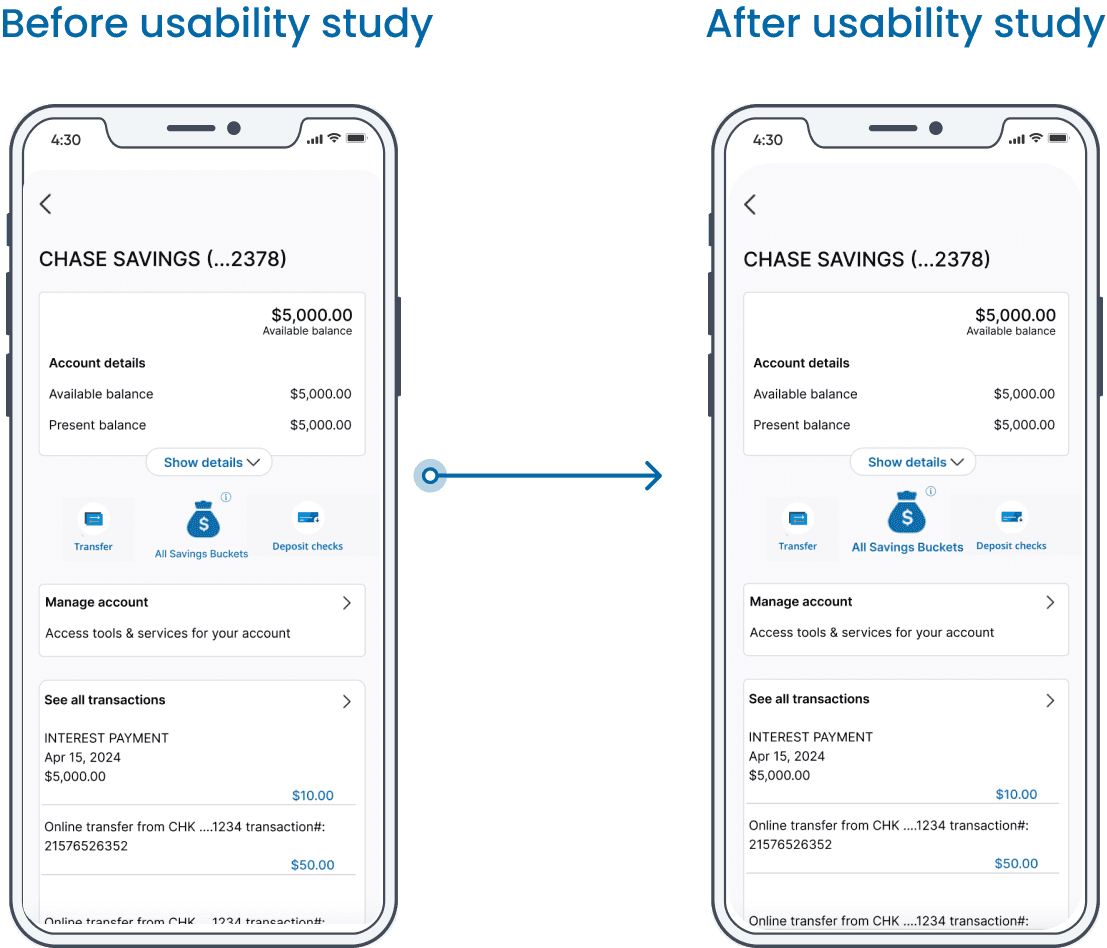

Affinity Mapping

Insights

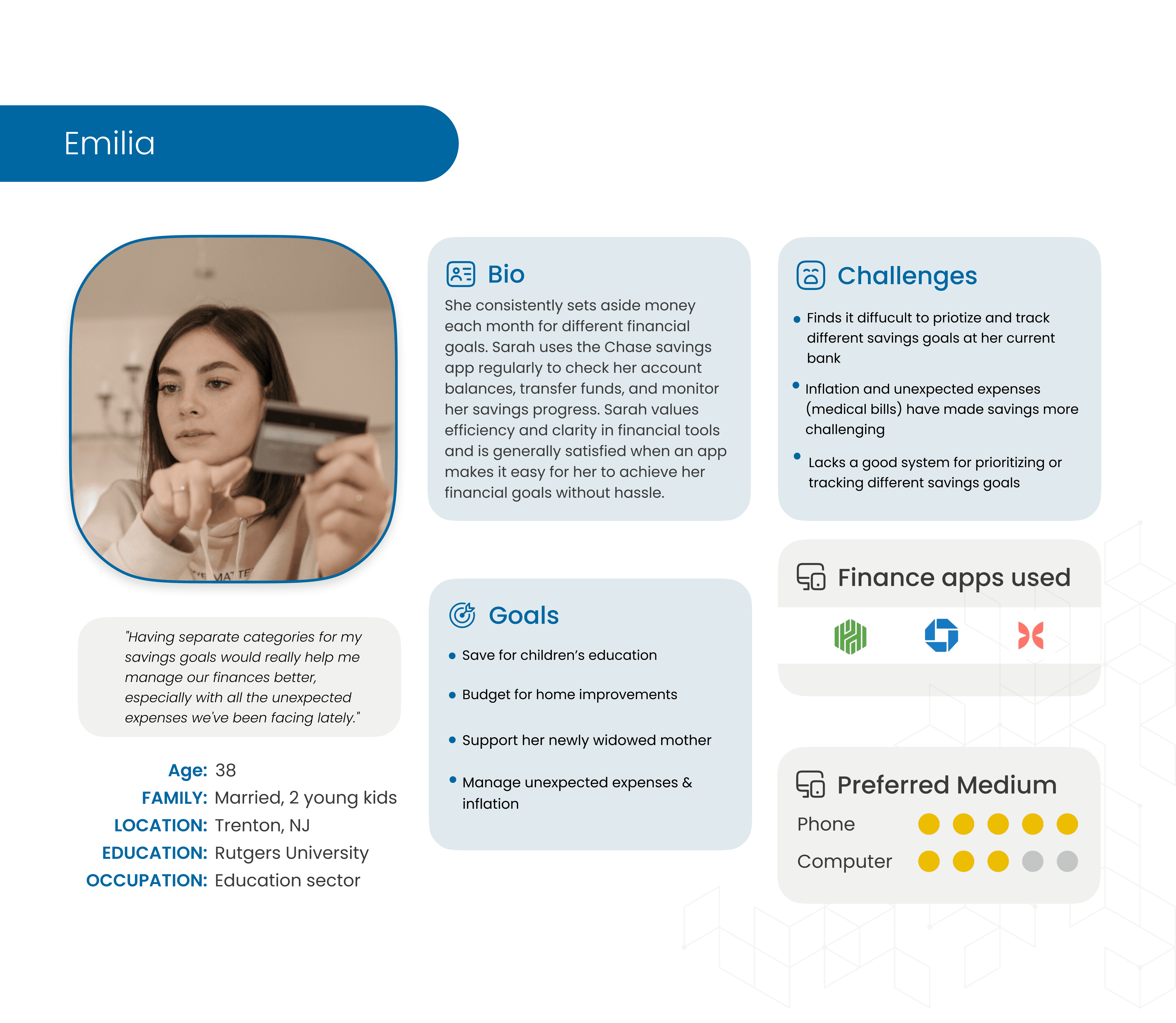

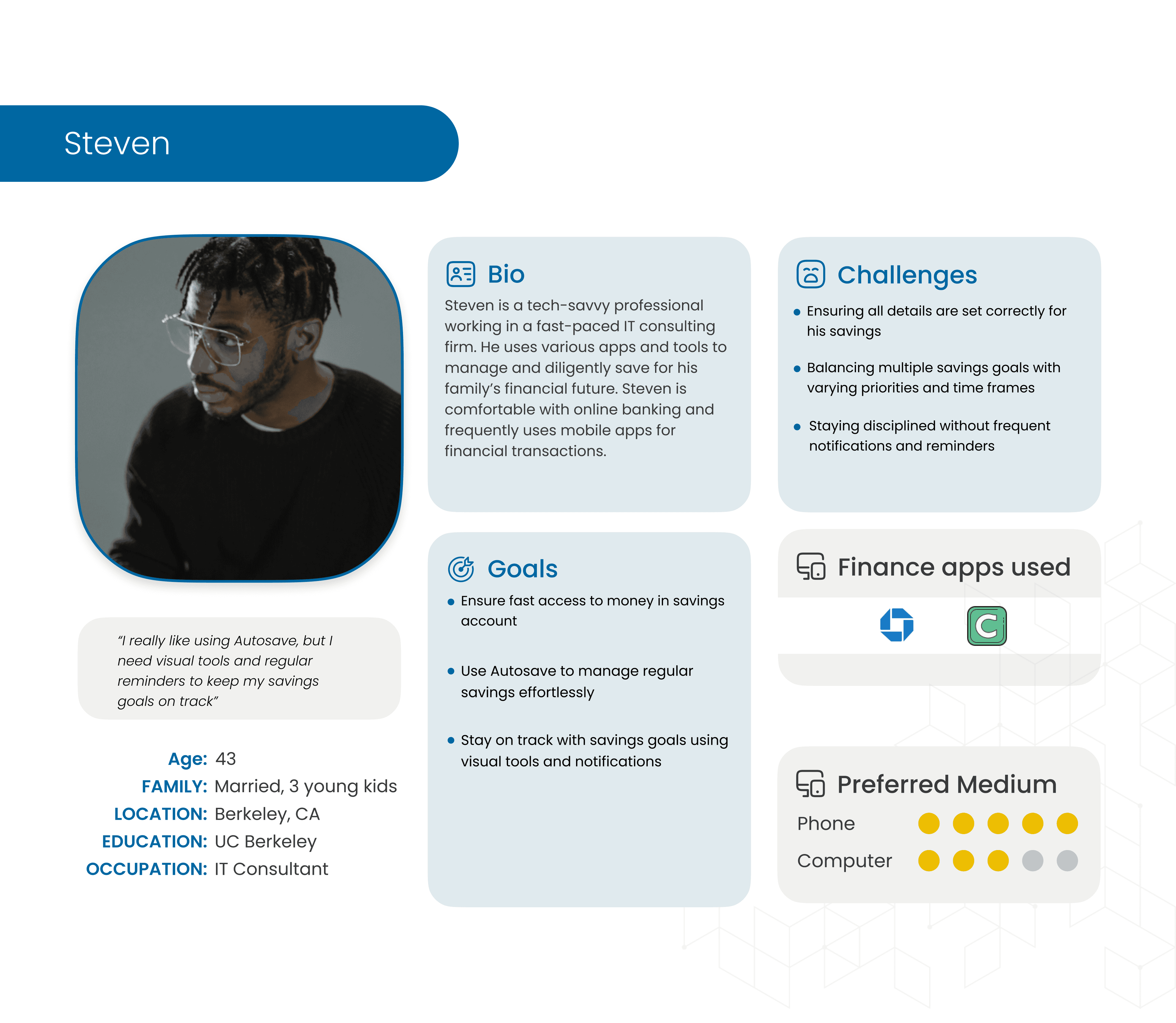

Life changing events such as growing children, supporting a widowed parent, home maintenance repairs, economy changes and medical expenses shows a need to save for different areas in life.

Customers have various financial apps but no core savings account to save for different savings goals; having separate "buckets" or categories for different savings goals in an app would improve their financial management and ability to adjust to changing priorities.

Customers don't have a good system for prioritizing or tracking different savings goals.

Some customers like greater control over their savings goals to monitor, track & visualize their progress.

User Persona

User flow

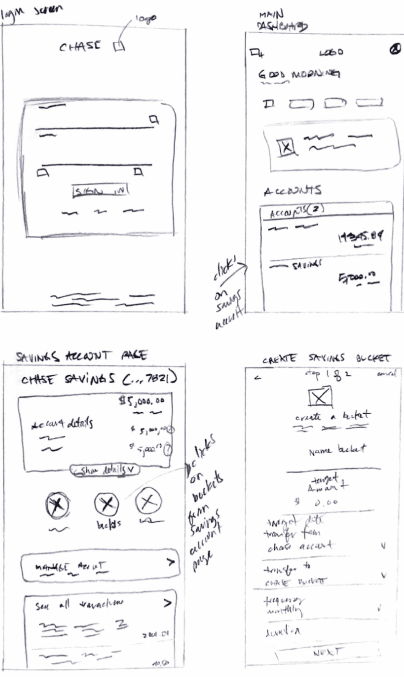

Low Fidelity Wireframes

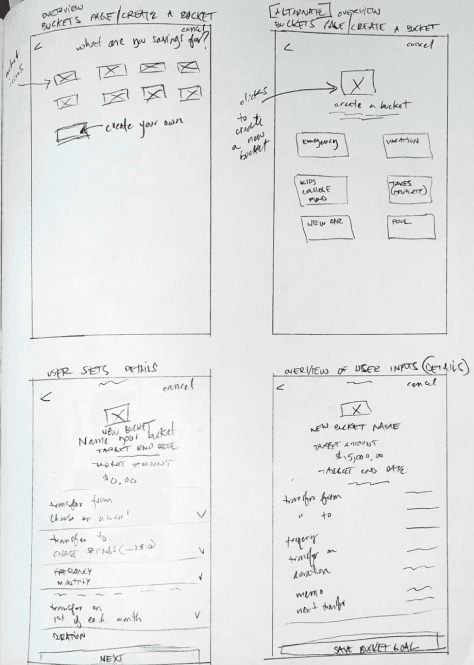

Mid Fidelity Wireframes

After creating initial wireframe sketches, we revisited the mid-fidelity wireframes with a focus on simplicity, removing unnecessary and confusing screens to better align with Chase's minimalist aesthetic.

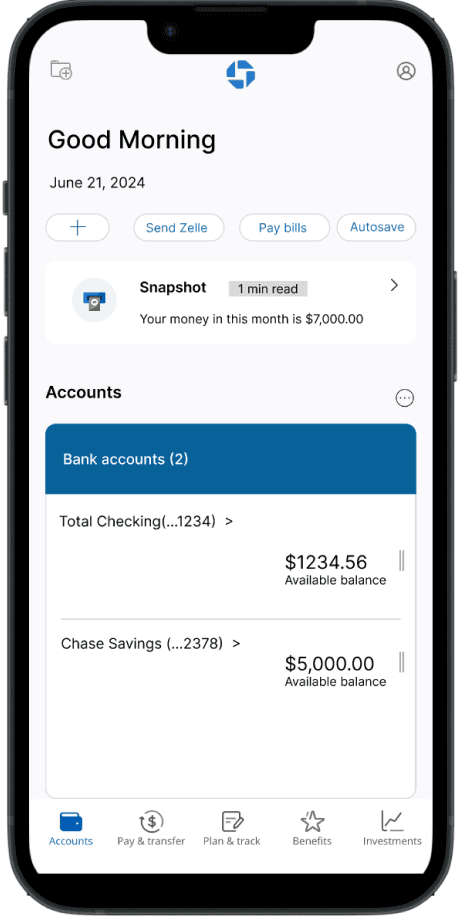

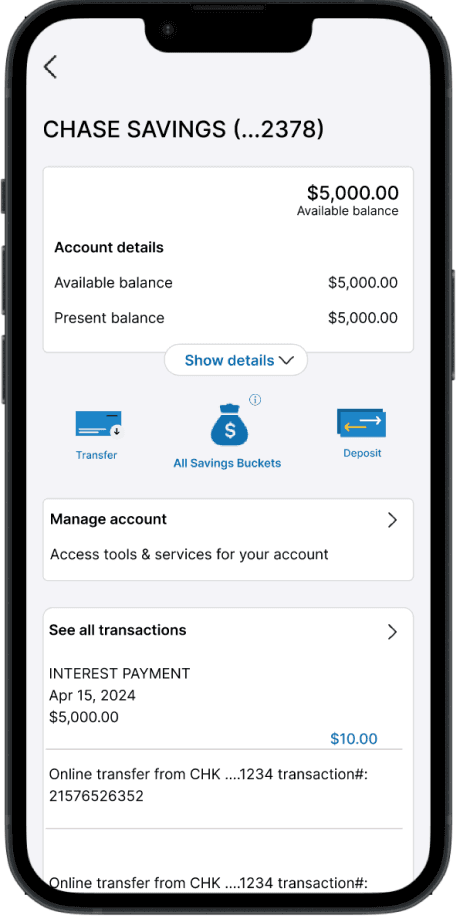

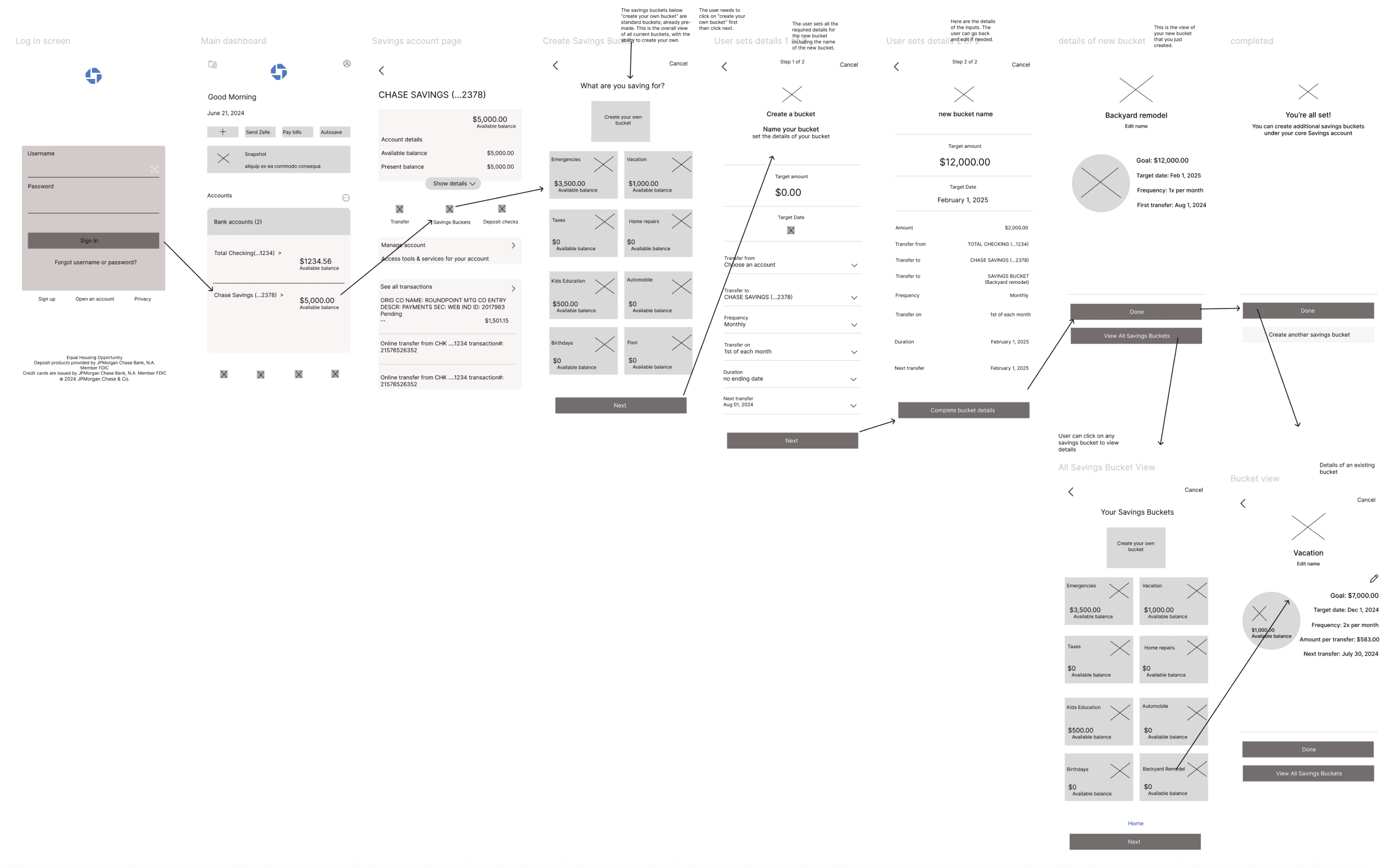

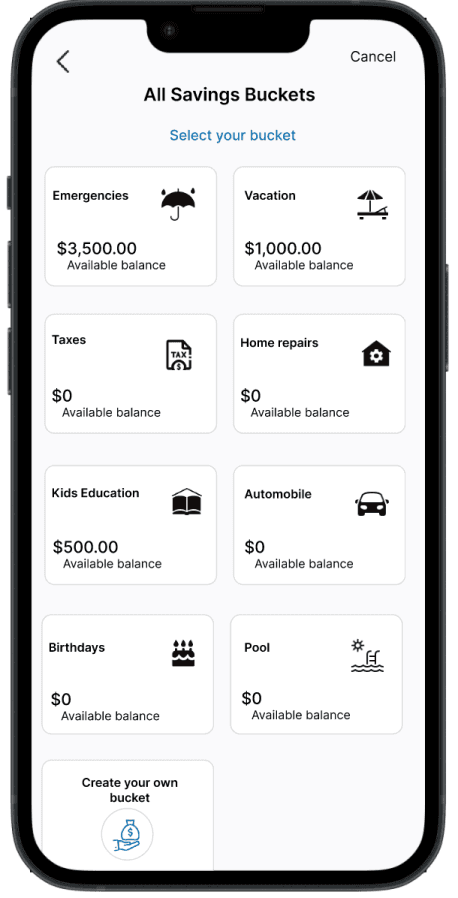

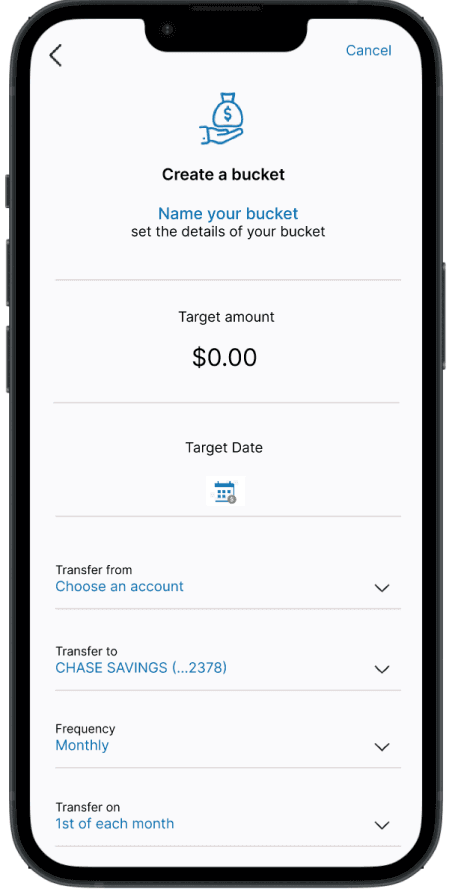

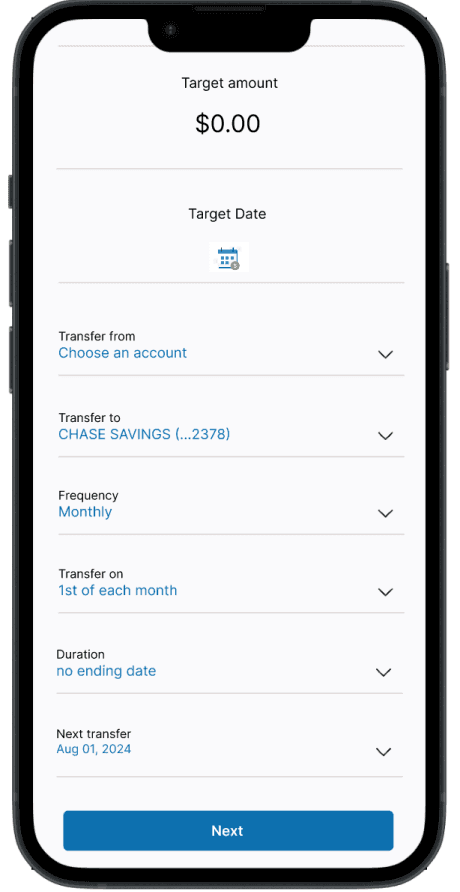

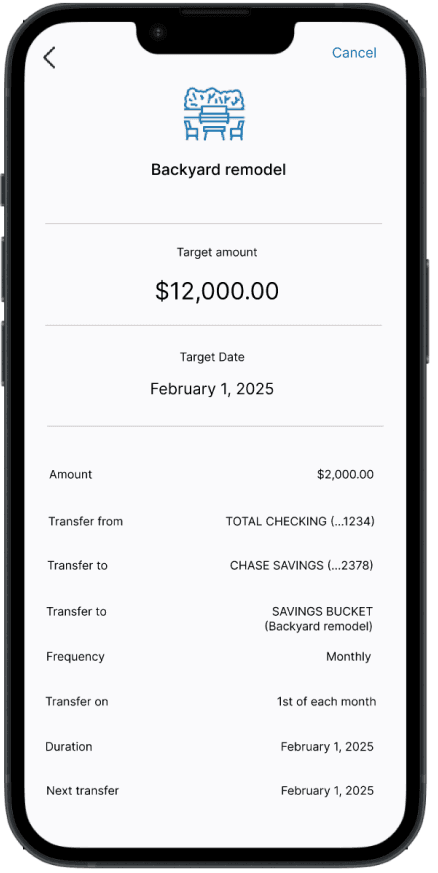

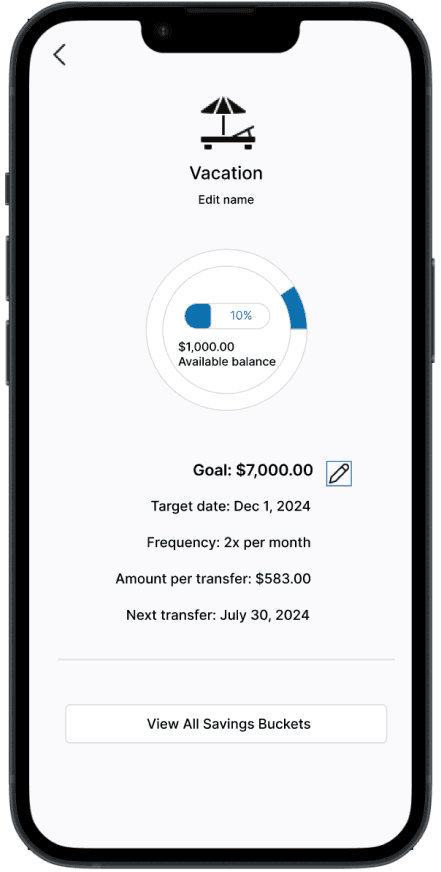

Hi Fidelity Mockups

Savings Buckets final prototype screens were designed to empower users to turn their financial aspirations into reality. Allocate money with purpose - be intentional with hard-earned money and set clear goals.

Prototype

Usability Testings

The savings bucket feature received mixed feedback. One user stated he couldn’t find the buckets. Two users would not use the savings bucket feature, as one said he uses the app only to check his balance on the app and the other user said he “already uses a similar app that is not accessed within my bank account so I am less likely to touch it while saving for goals.” (*It’s important to note that the usability test participants were different participants from the user interview participants during the research phase)

Key Insights

Understanding and Visibility: The feature may need to be made more prominent within the app to ensure users can easily find it. A visual guide or information regarding the concept of savings buckets may need to accessible for some users.

User engagement: The feature's appeal may vary depending on individual banking, financial habits and preferences for separate saving and financial apps.

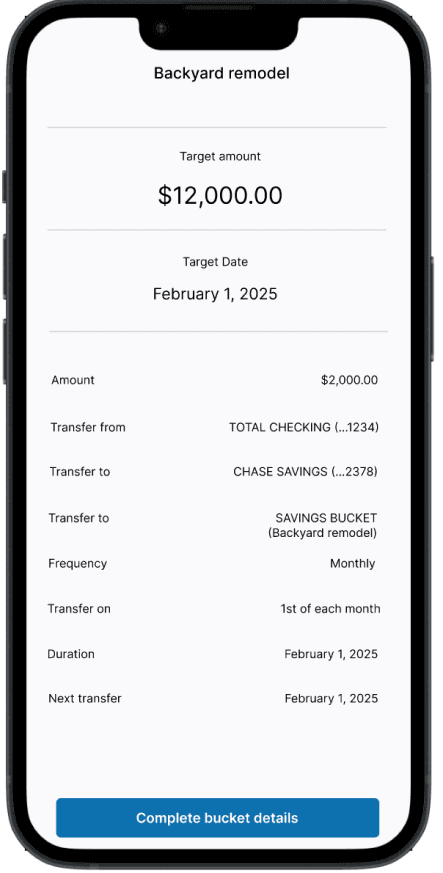

The savings bucket icon's size was increased based on one user’s feedback.

Impacts

Impact 1

Savings buckets helps you visualize your goals, so you can reach your financial goals faster.

Impact 2

Concept of savings buckets well-received during user interview phase.

Impact 3

Usability testing with a different set of new participants revealed mixed feedback on the viability of savings buckets.

Impact 4

Some people prefer to save through setting and forgetting it but are not aware of how they will reach their financial goal if any. Some may not have a specific financial goal when saving money.

Lessons & Next Steps

Lessons Learned

Whlle participants from the user interviews expressed a strong interest for the introduction of a savings bucket feature, the usability testing participants (a different set of 5 users) - three users expressed they would not use the savings bucket since they use other financial apps and only use the Chase app to check their current balance in their savings account.

Next Steps

a) Gather more feedback with a larger pool of participants to better understand why some users prefer using separate saving apps.

b) Consider creating an additional screen in the future to provide more guidance or tutorials for users who are unfamiliar with a “savings bucket” concept.